how to answer are you exempt from federal withholding

Every time you fill out a W-4 you might be wondering Am I exempt from federal withholding To claim exemption you must meet a set of criteria. If you can be claimed as a dependent on someone elses tax return you will need an estimate of your wages for this year.

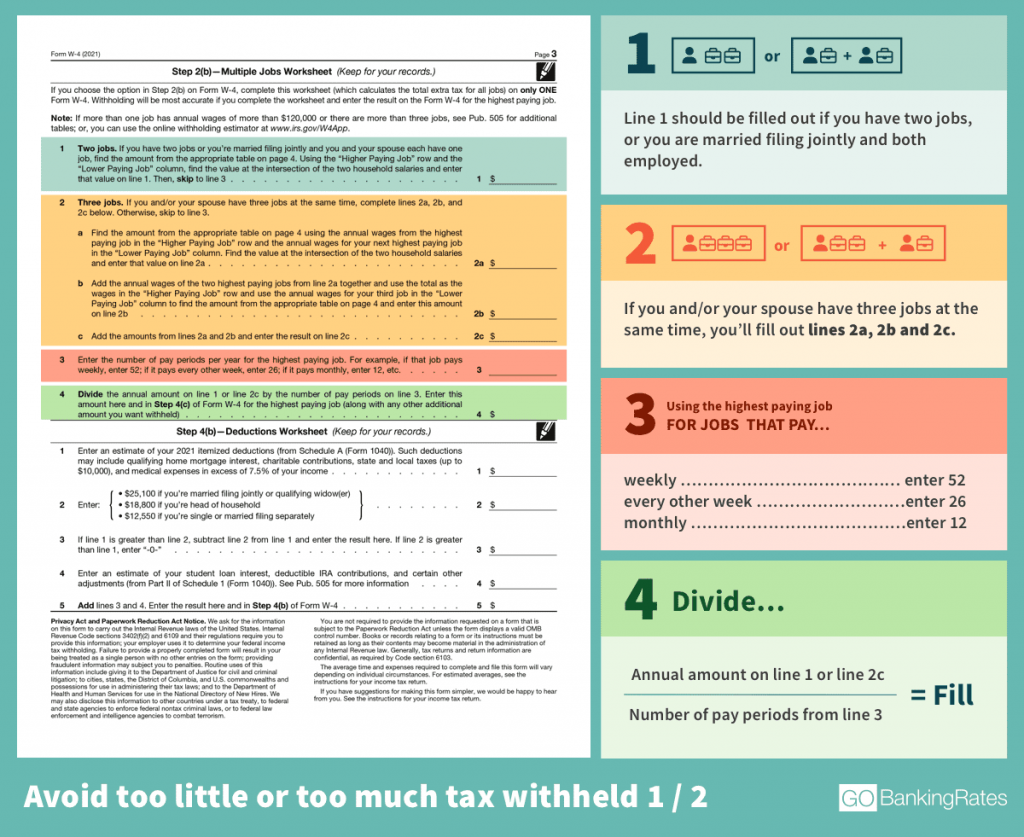

How To Fill Out A W 4 A Complete Guide Gobankingrates

Withholding allowances vary from.

. O Last year you had a right to a full refund of All federal tax income and o This. Defining Tax Exempt Tax-exempt refers to income or transactions that are free from tax at the federal state or local level. Being exempt from federal withholding means your employer will not withhold federal income tax from your paycheck.

When you file as exempt from withholding with your employer for federal tax withholding you dont make. If your employee claims. If an employee wants to claim exemption they must write Exempt.

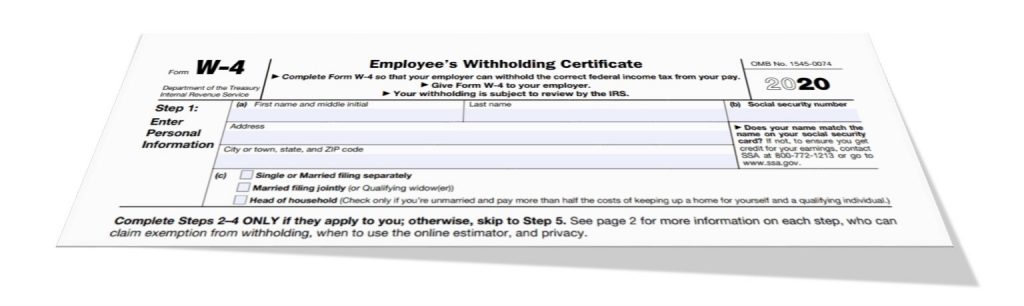

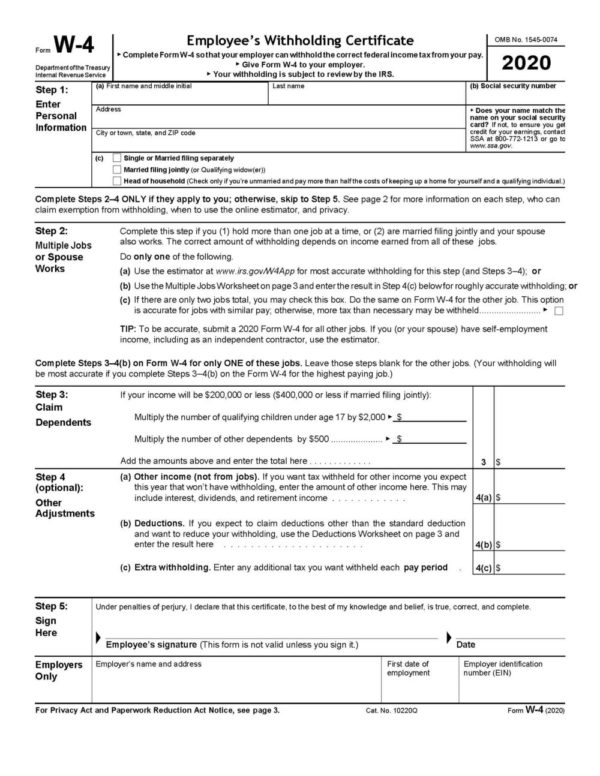

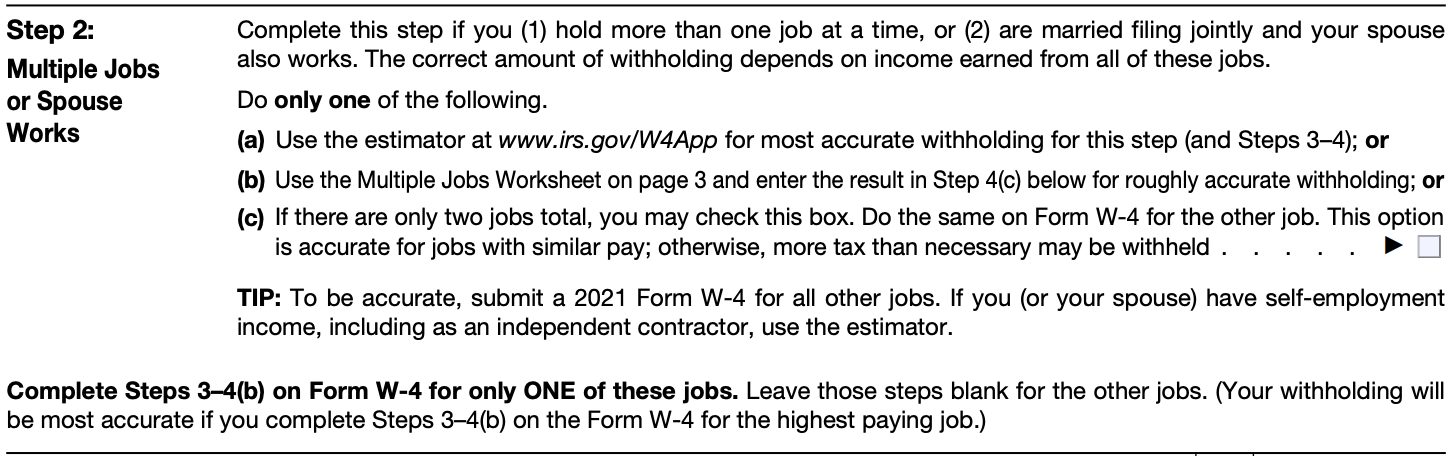

What Does Filing Exempt on a W-4 Mean. A new W-4 form is now in effect for all new hires and employees who want to change their W-4 forms. Each pay period your employer withholds money from your paycheck and sends it as a tax payment to the Internal Revenue Service on your behalf.

You can claim up to three allowances on the W-4 form. Form W-4 tells your employer how much Federal income tax to withhold from your pay. The more allowances you claim the less your employer will withhold from each check and send to the government.

So in your case if you made. This is great if you owe. What should I put for federal withholding.

Until the employee furnishes a new Form W-4 the employer must withhold from the employee as from a single person. The only way that you or any other taxpayer gets back all of the federal tax withheld is if their taxable income is zero or their tax is reduced to zero by credits. The reporting of tax-free items may be on a.

You may claim EXEMPT from withholding if. If you start a new job and fill out a Form W-4 claiming exemption your employer is required to withhold nothing from your paycheck for federal taxes. List -2 Types of Payments Exempt from Tax Withholding.

Interest and dividend payments - All exempt payees except for 7. Your company will deduct. What is the withholding tax rate for 2021.

If however a prior Form W-4 is in effect for the. If you want to claim complete exemption from. The longer answer is.

When you claim certain deductions they get. When you file Form W-4 your employer uses this information to withhold the correct federal income tax from your pay. An estimate of your income for the current year.

You owed no federal income tax in the prior tax year and. On your W-4 enter your identifying information such as your name address and Social Security number. You can tell your boss how.

W-4 Tax Withholding Allowances. If you had no tax liability in the prior year and you do not expect to owe anything in the current year you might qualify to be exempt from federal income tax withholding. Write Exempt in the space below Step 4c Complete Steps.

Do not complete lines 5 and 6 and write Exempt in the box on line 7. To be exempt from withholding both of the following must be true. Typically though you can.

To claim exempt from federal withholding you need to fill out a W-4 Form and write the word EXEMPT on line 7. Broker transactions Exempt payees 1 through 4 and 6 through 11. 10 12 22 24 32 35 and 37.

The federal withholding tax. The federal withholding tax has seven rates for 2021. This form is completed by the employer and instructs them on how much to deduct from each paycheck.

To claim exempt write EXEMPT under line 4c.

.png)

Form W 9 What Is It And How Is It Used Turbotax Tax Tips Videos

How To Know If I Am Exempt From Federal Tax Withholding Sdg Accountants

The Percentage Withholding Method How It Works Paytime Payroll

Practical War Tax Resistance 1 National War Tax Resistance Coordinating Committee

W 4 Reminder For Updated Employee Withholding Certificates Primepay

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Am I Exempt From Federal Withholding Do I Still Get A Refund Gobankingrates

Am I Exempt From Federal Withholding H R Block

Exempt From Withholding Employees Claiming To Be Exempt

What Should Employers Know About Payroll Withholding Business Com

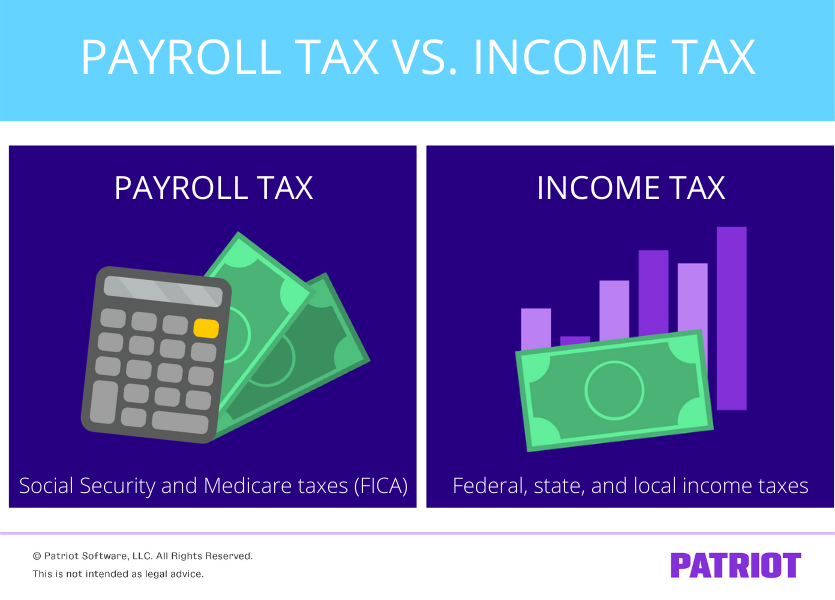

How Are Payroll Taxes Different From Personal Income Taxes

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Many Tax Allowances Should You Claim Smartasset

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

How To Fill Out A W 4 A Complete Guide Gobankingrates