federal income tax canada

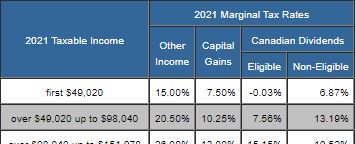

There are seven federal tax brackets for the 2021 tax year. 58 rows For example lets say you made 50000 in employment income and you live in Ontario.

Personal Income Taxes And The Capital Gains Tax Fraser Institute

10 12 22 24 32 35 and 37.

. IRS Publication 597. 15 on the first 49020 of taxable income and. File taxes and get tax information for individuals businesses charities and trusts.

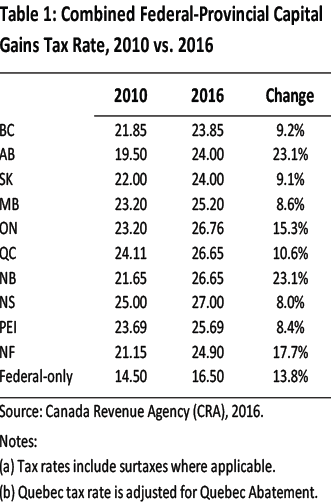

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Quebec has its own personal tax system which requires a separate calculation of taxable Income. How Canadas personal income tax brackets work How much federal tax do I have to pay based on my income.

Canada Federal Income Tax Brackets and Other Information. The rates for the year 2014 are as follows. Your bracket depends on your taxable income and filing status.

This means that your income is split into multiple brackets. If your taxable income is less than the 50197 threshold you pay. 22 on taxable income between 43954.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax. 2023 Federal Income Tax Bracket s and Rates. Income tax GSTHST Payroll Business number Savings and pension plans Child and family benefits.

Federal Tax Bracket Rates for 2021. Find out about Canada Revenue Agencys new benefits and other changes that support Canadians during the COVID-19 pandemic. Personal income taxes are a crucial part of the governments revenue.

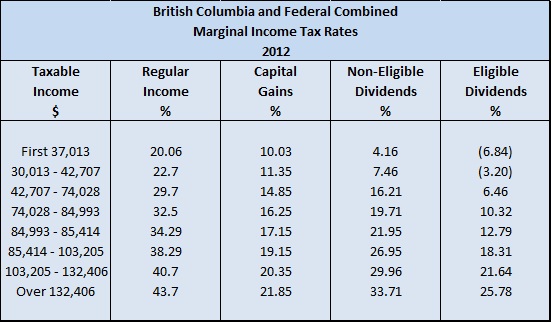

In Canada income tax is charged by the Canadian government on income you earn and is the main source of revenue for the government. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. Recognising that Quebec collects its own tax federal income tax is reduced by.

A document published by the Internal Revenue Service IRS that provides information on the income tax treaty between the United States and Canada. TurboTax free Canada income tax calculator for 2022 quickly estimates your federal and provincial taxes. You will be required to pay both federal and.

15 on taxable income of up to 43953. Find out your tax refund or taxes owed plus federal and provincial tax rates. Changes to taxes and benefits.

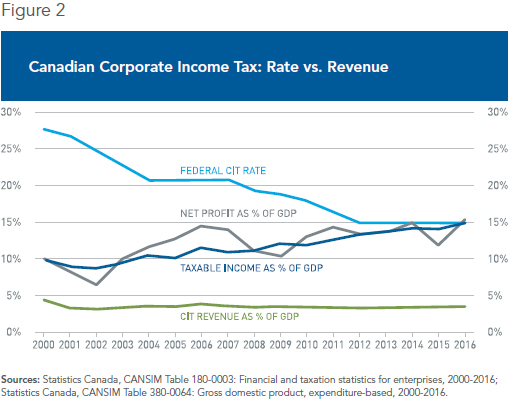

The federal tax rate varies between 15-29 based on income. The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. To pay off debt the government generally needs to increase income which means higher taxes.

The personal income tax system in Canada is a progressive tax system. Thats in the second tax bracket both federally and provincially.

Taxtips Ca Canada S Federal 2020 2021 Personal Income Tax Rates

Federal Corporate Income Tax Revenues Actual And As A Percentage Of Download Table

Incorporation Benefit Lower Income Tax Rates The Professional Edge

Canadians May Pay More Taxes Than Americans But There S A Catch

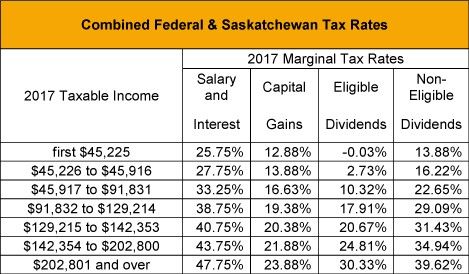

Saskatchewan 2017 Budget Sales Taxes Vat Gst Canada

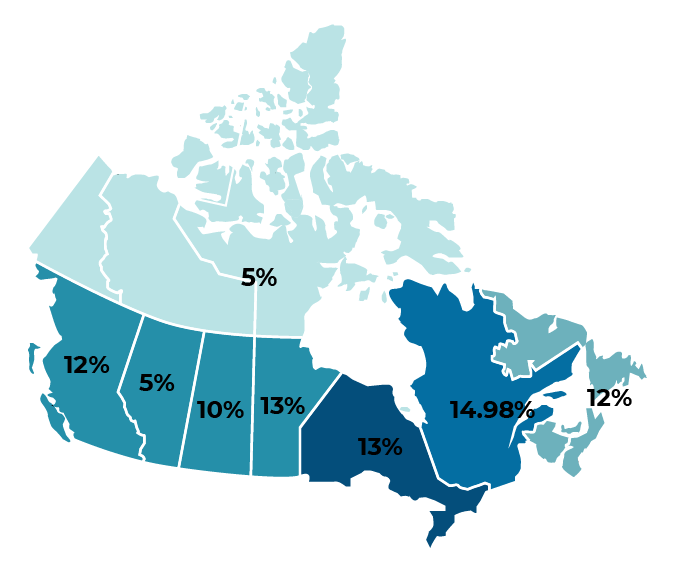

Which Province In Canada Has The Lowest Tax Rate Transferease

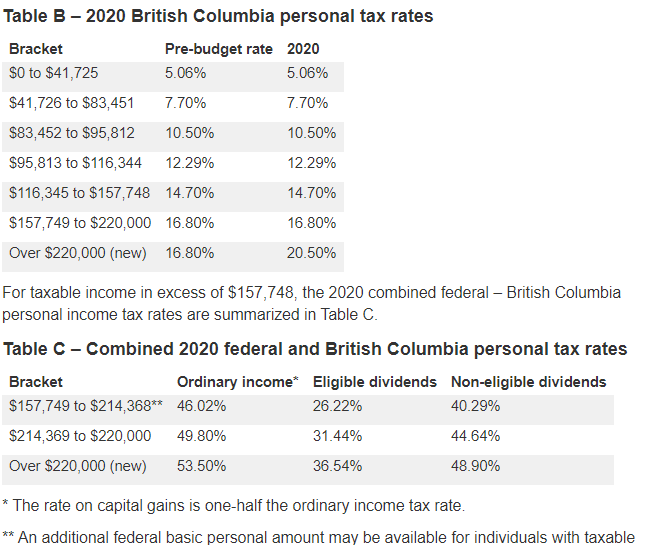

Canada British Columbia Issues Budget 2020 21 Ey Global

Bundle 2021 2022 Introduction To By Nathalie Johnstone 9781773791555 Redshelf

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

Calculate Your Personal Income Tax In Canada For 2020 2021 Credit Finance

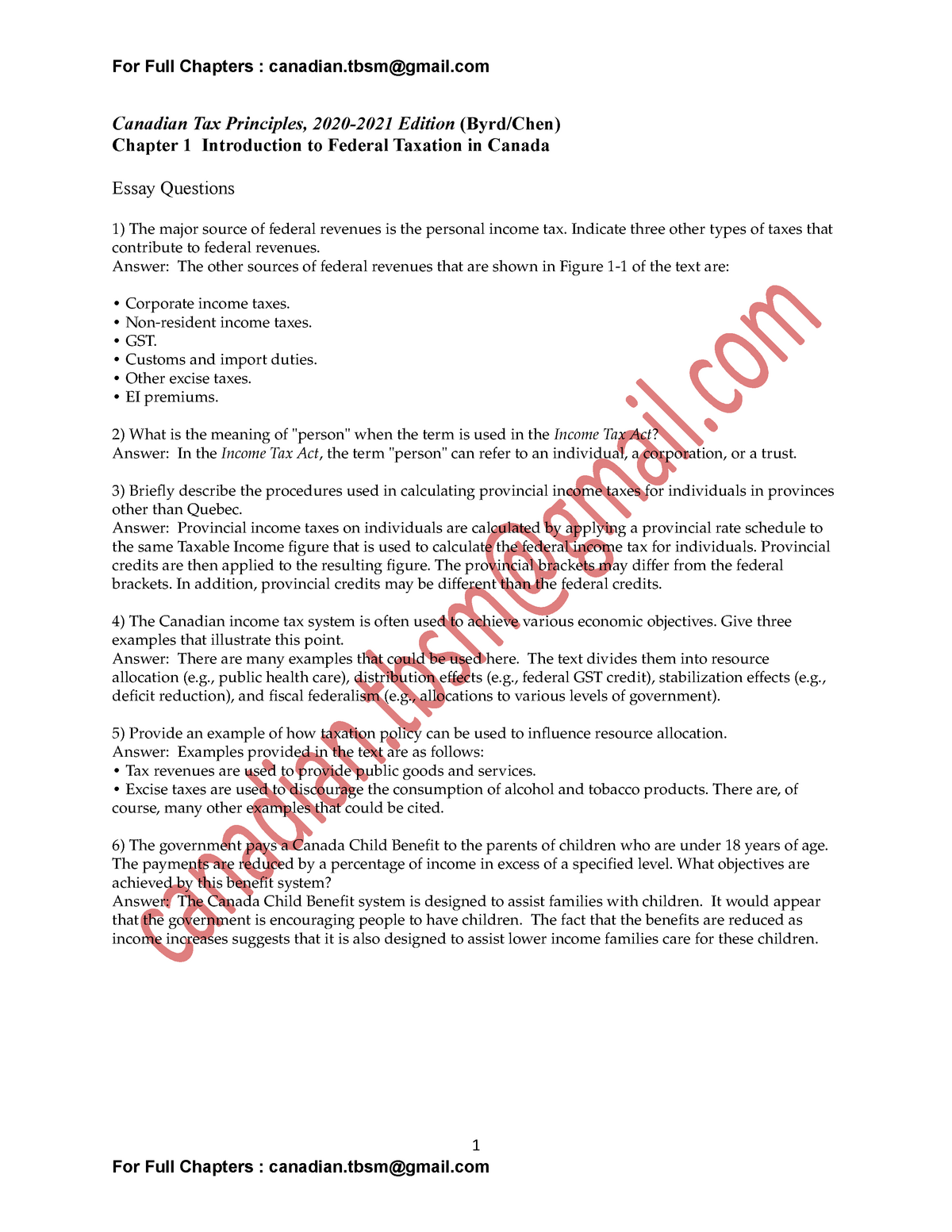

Solutions And Test Bank For Byrd Chen S Canadian Tax Principles 2020 2021 Edition Volumes I And Studocu

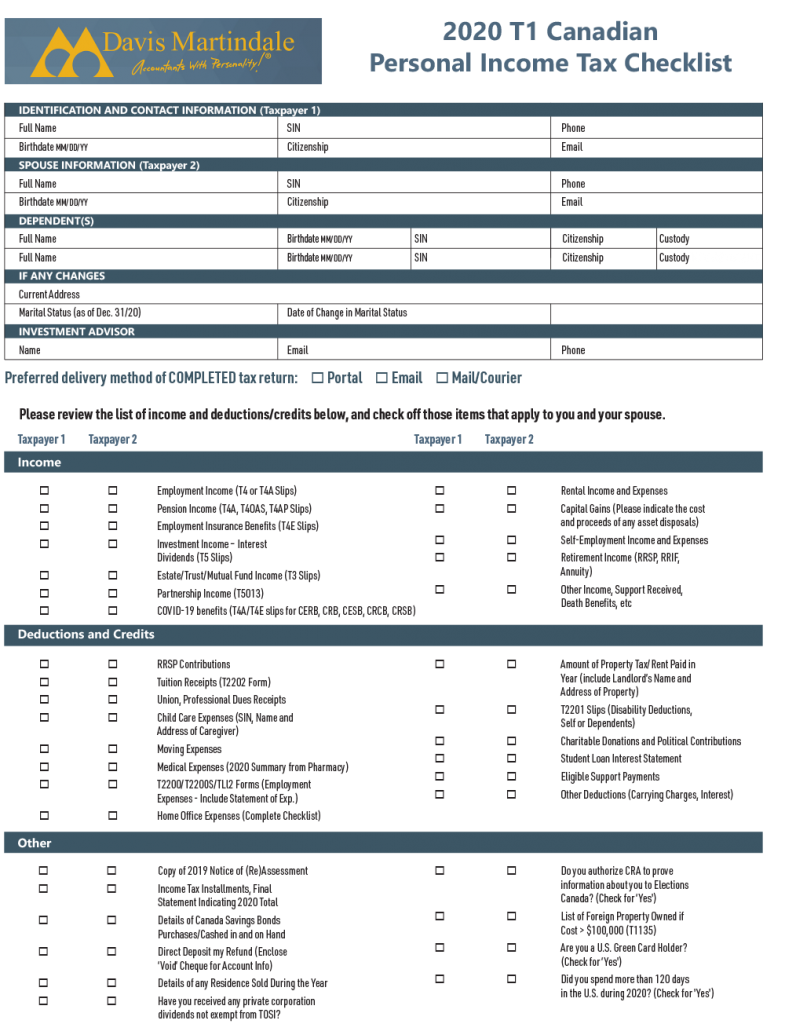

2020 Canadian Personal Income Tax Checklist Davis Martindale

Personal Income Tax Brackets Ontario 2021 Md Tax

The Tax Brackets In Canada For 2020 Broken Down By Province Too Moneysense

High Income Earners Need Specialized Advice Investment Executive

Easy Examples Of How Tax Works In Canada 2020 Youtube

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

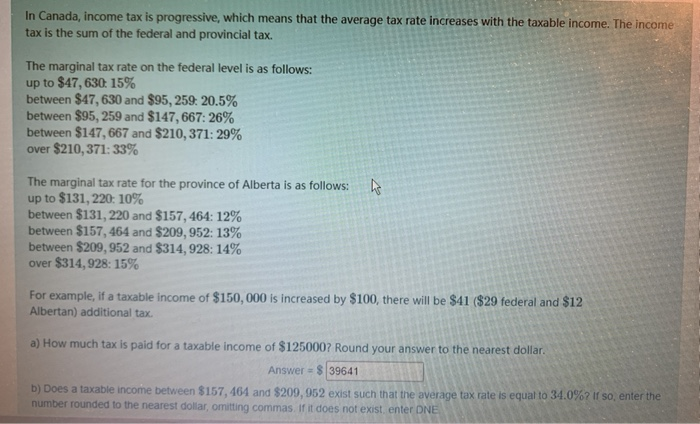

Solved In Canada Income Tax Is Progressive Which Means Chegg Com